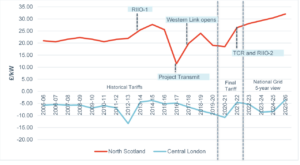

Annual Transmission Network Use of System costs for a typical 40MW onshore wind site in Northern Scotland are forecast to rise to £1.28mn by 2025-26, an increase of 180% in nine years where costs stood at £0.46mn in 2016-17.

This is according to Cornwall Insight’s further analysis into National Grid’s five-year view of Transmission Network Use of System (TNUoS) charges.

Laura Woolsey, Analyst at Cornwall Insight, commented on the findings: “Charging methodologies for TNUoS utilise location-based signals, and generators in regions where power is assumed to be flowing further to reach customers will face higher charges than those deemed closer to demand.

“Power flows have typically been north to south, with historic economic factors typically seeing higher demand bases in the south and greater levels of power generation in the north.

“The trend for more northern located generators has been magnified by the growth of onshore wind in Scotland.

“With TNUoS charges rising by 180% in nine years, it is little surprise they have attracted concerns from developers in Scotland, particularly those in Northern Scotland.

“Some developers are now seeing these costs as a potential barrier for further deployment of renewables assets on the pathway to net zero.

“While locational signals are important in incentivising generators to locate closer to demand, many generators face little option on development locations.

“Put more frankly, large onshore wind developments are only viable in a few specific locations across the country.

“Notably, Northern Scotland and incentives to locate further south to benefit from the lower network charging are unlikely to align with other requirements such as wind speeds, land costs and the likelihood of planning approval.

“There are several regulatory changes currently paused or awaiting a decision. These potentially include changing the expansion constant calculation (CMP 315), which could stretch and enhance locational signals and reforms to the current 27 charging zones.

“Whilst the outcome of these reforms is uncertain, it is clear TNUoS charges and associated regulatory interactions now form a material part of the business case assessment for new build assets, especially those in Scotland.”

The below graph shows these long-term trends in TNUoS charges, using Northern Scotland and Central London as two examples at different ends of the charging spectrum.